Quick Summary

Capitec Bank offers a streamlined process for applying for a temporary loan, which can be done online, through their app, or by visiting a branch. To apply, you’ll need to provide your ID document, the latest salary slip, and a bank statement (if your salary isn’t deposited into a Capitec account). Approval depends on your credit profile and affordability, and mandatory credit insurance is required. With flexible repayment options and quick approval times, Capitec makes accessing temporary financial support straightforward and efficient.

Introduction

Navigating the process of securing a temporary loan can be overwhelming, but Capitec Bank simplifies it with its user-friendly approach. Whether you’re facing unexpected expenses, planning a home renovation, or just need a bit of extra cash, Capitec offers a straightforward application process designed to get you the funds you need quickly and efficiently.

In this comprehensive guide, we’ll walk you through the steps to apply for a temporary loan at Capitec. We’ll cover everything from the application methods to the required documentation and factors influencing approval. By the end, you’ll be equipped with all the information needed to confidently apply for your temporary loan.

Understanding Temporary Loans at Capitec

What is a Temporary Loan?

A temporary loan is a short-term financial solution offered by Capitec Bank for addressing immediate needs. Unlike long-term loans, these are designed to be repaid quickly, usually within a few months. They are ideal for managing urgent expenses or bridging financial gaps.

Key Features:

- Short-Term Repayment: Typically repaid within a few months.

- Flexible Loan Amounts: Borrow an amount that suits your specific needs.

- Fast Approval: Streamlined process for quicker access to funds.

Benefits of Choosing Capitec for Your Temporary Loan

Capitec Bank’s temporary loans stand out due to their simplicity and efficiency:

- User-Friendly Application: Apply online, through the app, or in person.

- Quick Processing: Fast approvals, often within minutes.

- Competitive Rates: Attractive interest rates and flexible terms.

- Comprehensive Support: Dedicated customer service to assist with your application.

Common Uses for Temporary Loans

Temporary loans can be used for a variety of short-term financial needs:

- Emergency Expenses: Unexpected medical bills or urgent repairs.

- Home Renovations: Minor improvements or repairs to your home.

- Debt Consolidation: Combining smaller debts into a single payment.

- Personal Projects: Funding personal goals or special events.

How to Apply for a Temporary Loan at Capitec

Capitec offers multiple convenient ways to apply for a temporary loan. Here’s a step-by-step guide to help you through the process:

1. Choose Your Application Method

You have three options for applying for a temporary loan at Capitec:

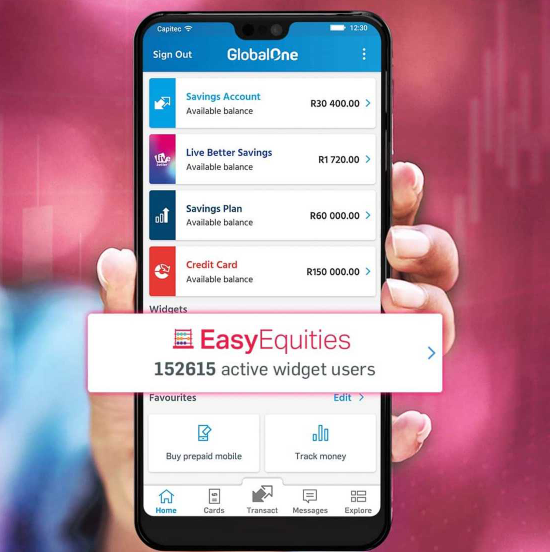

Apply Online or via the Capitec App

- Online Application: Visit Capitec’s official website and follow the instructions to apply online.

- Capitec App: Download the Capitec Banking App from your device’s app store and complete your application through the app.

Example: If you’re at home and want a quick application process, the Capitec app allows you to apply directly from your smartphone without needing to visit a branch.

Call Capitec Customer Service

- Phone Application: Call Capitec’s customer service line at 0860 66 77 89. A consultant will guide you through the application process and answer any questions you may have.

Example: If you prefer a personal touch and need assistance while applying, calling the customer service line ensures you have support throughout the process.

Visit a Capitec Branch

- In-Person Application: Visit one of Capitec’s branches across South Africa. The staff will assist you in completing the application and answer any queries you might have.

Example: For those who prefer face-to-face interactions, visiting a branch can provide direct support and immediate assistance.

2. Prepare Your Required Documents

To ensure a smooth application process, gather the following documents:

- Original ID Document: You must be 18 years or older and provide a valid South African ID or Smart ID Card.

- Latest Salary Slip: This verifies your income and employment status.

- Bank Statement: If your salary is not paid into a Capitec account, provide a bank statement showing the latest three consecutive salary deposits.

Table: Required Documents

| Document | Purpose |

|---|---|

| Original ID Document | Verifies your identity and age. |

| Latest Salary Slip | Confirms your income and employment status. |

| Bank Statement (if applicable) | Shows proof of income if not paid into a Capitec account. |

3. Submit Your Application

- Online or App Submission: Complete your application online or through the app, ensuring all required documents are uploaded.

- Phone Submission: Provide your documents and information during the call with the customer service representative.

- In-Person Submission: Submit your documents at the branch, where staff will process your application.

4. Await Approval

Capitec’s approval process is designed to be quick. Once submitted, your application will be reviewed based on your credit profile and affordability. You’ll receive a decision promptly, often within minutes if applying online or via the app.

Example: If approved, you’ll receive the loan amount directly into your bank account, allowing you to address your financial needs immediately.

Applying for a temporary loan at Capitec is a straightforward process designed to provide quick and flexible financial solutions. Whether you choose to apply online, through the app, or in person, Capitec’s user-friendly approach ensures that you have access to the funds you need with minimal hassle.

Stay tuned as we explore the factors that influence loan approval and the importance of credit insurance in our next sections. If you have any questions or need further assistance, don’t hesitate to reach out!

Required Documents for a Temporary Loan Application

When applying for a temporary loan at Capitec, having the right documents ready can streamline the process and ensure a swift approval. Here’s a detailed list of the documents you’ll need:

Essential Documents

1. Original ID Document

- Purpose: Verifies your identity and age. You must be at least 18 years old.

- Accepted Forms: South African ID book, smart ID card, or valid passport.

Example: If you’ve recently changed your address, ensure that your ID reflects your current details. An updated ID ensures there are no discrepancies during the application process.

2. Latest Salary Slip

- Purpose: Confirms your income and employment status. It helps Capitec assess your ability to repay the loan.

- Details Required: Must include your name, employer’s name, and salary details. The slip should be from the most recent month.

Table: Salary Slip Details

| Detail | Description |

|---|---|

| Employee Name | Your full name as it appears on your payslip. |

| Employer’s Name | Name of the company or organization. |

| Monthly Salary | Your gross salary before deductions. |

| Deductions | Taxes and other deductions from your salary. |

Example: If you receive bonuses or commissions, these should also be documented if they contribute to your overall income.

3. Bank Statement

- Purpose: Provides proof of income if your salary is not paid into a Capitec account.

- Details Required: Recent statements showing the latest three consecutive salary deposits or other sources of income.

Tips for Bank Statements:

- Ensure statements are from the last three months.

- Statements should be clear and easy to read.

- Highlight or annotate salary deposits if needed for clarity.

Example: If your salary is deposited into a bank account other than Capitec, make sure the statements reflect regular deposits and are not missing any critical information.

Optional Documents

Depending on your situation, you may also be asked to provide additional documentation:

- Proof of Residence: Recent utility bill or lease agreement.

- Additional Income Proof: If you have additional income sources, such as rental income or freelance work, provide supporting documents.

Example: If you’re self-employed, additional documents like tax returns or business financial statements may be required to verify your income.

Factors Influencing Loan Approval

Securing a temporary loan involves more than just submitting your documents. Capitec considers several factors to determine your eligibility. Understanding these factors can help you prepare a stronger application.

1. Credit Score

- Impact: A higher credit score increases your chances of approval. It reflects your creditworthiness and repayment history.

- Tip: Obtain your credit report in advance and check for any inaccuracies. Regularly maintaining a good credit score can improve your loan prospects.

Example: If you have a high credit score, you’re more likely to receive favorable loan terms, including lower interest rates.

2. Income and Employment Stability

- Impact: Regular and sufficient income demonstrates your ability to repay the loan. Stable employment history is also favorable.

- Tip: Ensure your salary slip and bank statements accurately reflect your income. Any gaps in employment or irregular income may affect your application.

Example: A consistent employment record and a stable income from a reliable employer are positive indicators for loan approval.

3. Debt-to-Income Ratio

- Impact: This ratio compares your total debt to your income. A lower ratio suggests you can manage additional debt comfortably.

- Tip: Calculate your debt-to-income ratio by dividing your total monthly debt payments by your monthly income. Aim for a ratio below 40%.

Example: If your total debt payments are $1,000 per month and your monthly income is $3,000, your debt-to-income ratio is approximately 33%, which is generally acceptable.

4. Loan Amount and Repayment Terms

- Impact: The amount you wish to borrow and the repayment period can influence approval. Capitec assesses if the loan amount and terms are manageable for your financial situation.

- Tip: Borrow only what you need and choose a repayment term that fits your budget. Avoid overextending yourself.

Example: If you request a loan amount that is significantly higher than your current income allows, it might raise concerns about your ability to repay.

5. Existing Loans and Financial Obligations

- Impact: Existing loans and financial commitments are assessed to ensure you can handle additional borrowing.

- Tip: Be transparent about all existing financial obligations. Having a manageable number of loans and financial commitments is beneficial.

Example: If you already have a mortgage and a car loan, ensure that your new loan will not strain your finances further.

Credit Insurance for Capitec Personal Loans

Credit insurance is an optional but valuable protection that Capitec offers for its personal loans. It safeguards both you and the lender in the event of unforeseen circumstances.

What is Credit Insurance?

Credit insurance covers your loan payments in case of unexpected events such as job loss, disability, or death. It ensures that your loan obligations are met even if you face financial difficulties.

Key Benefits:

- Peace of Mind: You won’t have to worry about loan payments if you’re unable to work due to illness or job loss.

- Protection for Your Family: Ensures that your family isn’t burdened with loan repayments in case of your death.

Types of Credit Insurance Coverage

- Job Loss Insurance

- Purpose: Covers loan payments if you lose your job involuntarily.

- Coverage Duration: Typically covers payments for a specified period or until you find a new job.

- Disability Insurance

- Purpose: Pays your loan installments if you become permanently or temporarily disabled and can’t work.

- Coverage: Ensures continuity of loan payments during your recovery or disability period.

- Life Insurance

- Purpose: Pays off the remaining loan balance in case of your death.

- Coverage: Provides financial protection for your beneficiaries.

Example: If you were to face a sudden job loss, credit insurance would cover your loan payments, alleviating financial stress during the transition period.

How to Apply for Credit Insurance

- During Loan Application: You can opt for credit insurance when applying for your temporary loan. The cost will be added to your loan repayments.

- Review Terms: Understand the terms, coverage details, and exclusions before committing.

Example: When applying for your loan online or at a branch, inquire about credit insurance options and select the coverage that best suits your needs.

Conclusion

Applying for a temporary loan at Capitec involves understanding the required documentation, factors influencing approval, and the benefits of credit insurance. By being well-prepared and informed, you can enhance your chances of securing the loan you need efficiently and confidently.

Frequently Asked Questions (FAQs) About Temporary Loans at Capitec

Navigating the world of temporary loans can raise many questions. Below are some of the most commonly asked questions about Capitec’s temporary loans, along with detailed answers to help clarify any uncertainties.

1. What is a temporary loan at Capitec?

A temporary loan at Capitec is a short-term financial product designed to provide quick access to funds for urgent needs. It is generally used for unexpected expenses or emergencies. Unlike long-term loans, temporary loans are intended to be repaid over a shorter period, typically within a few months.

2. How do I qualify for a temporary loan at Capitec?

To qualify for a temporary loan at Capitec, you need to meet certain criteria:

- Age: Must be at least 18 years old.

- South African Residency: Must be a South African citizen or a permanent resident.

- Income: Stable income and employment status are required.

- Credit History: A good credit history enhances your chances of approval.

- Documentation: Provide necessary documents such as your ID, salary slip, and bank statements.

Example: If you’re employed and have a steady income, along with a clean credit record, you are more likely to qualify for a temporary loan.

3. What is the maximum amount I can borrow with a temporary loan?

The maximum amount you can borrow varies depending on your income, creditworthiness, and Capitec’s lending policies. Generally, Capitec offers flexible loan amounts that can be adjusted to fit your needs and financial situation.

Tip: For more specific information, contact Capitec directly or use their online loan calculator to estimate the amount you might qualify for.

4. What are the repayment terms for a temporary loan?

Repayment terms for temporary loans at Capitec typically range from a few months up to a year. The exact term will depend on the loan amount, your financial situation, and the agreement made at the time of the loan application.

Example: If you take out a temporary loan of R10,000, you might be given a repayment period of 6 to 12 months, depending on your ability to repay.

5. What are the interest rates for temporary loans at Capitec?

Interest rates for temporary loans at Capitec are competitive and may vary based on your credit profile and the loan amount. Capitec provides transparent information about interest rates and fees, ensuring you understand the cost of borrowing before committing.

Tip: Review the interest rates and any associated fees carefully to fully understand the cost of the loan. Capitec’s website or customer service can provide detailed information on current rates.

6. How long does it take to get approved for a temporary loan?

Approval times for temporary loans at Capitec can be relatively quick. Depending on the completeness of your application and the verification process, you might receive approval within a few hours to a couple of business days.

Example: If you submit all required documents and information accurately, you could potentially get a decision within 24 hours.

7. Can I apply for a temporary loan online?

Yes, Capitec offers an online application process for temporary loans. You can complete the application through their website or mobile app, providing the necessary documentation and information.

Tip: Make sure you have all required documents ready when applying online to speed up the process.

8. What happens if I miss a loan payment?

Missing a loan payment can have several consequences, including late fees and a negative impact on your credit score. Capitec may offer solutions such as payment arrangements if you face financial difficulties.

Tip: Contact Capitec as soon as you anticipate missing a payment to discuss possible solutions and avoid penalties.

9. Is credit insurance mandatory for a temporary loan?

Credit insurance is optional but highly recommended. It provides protection in case of unforeseen circumstances such as job loss, disability, or death, ensuring that your loan payments are covered.

Example: If you opt for credit insurance, you will have an added layer of security, helping you manage your loan in case of unexpected events.

10. How can I check the status of my loan application?

You can check the status of your loan application by logging into Capitec’s online banking portal, using their mobile app, or contacting their customer service. They will provide updates on your application status and any additional steps required.

Tip: Regularly check your application status to stay informed about the approval process and any further actions needed.

Conclusion

In summary, Capitec’s temporary loans offer a convenient solution for individuals needing quick financial assistance. With flexible amounts, competitive interest rates, and a relatively straightforward application process, these loans can help bridge the gap during unexpected financial challenges. Understanding the requirements, application process, and terms of temporary loans is crucial for making informed decisions and managing your finances effectively.

Whether you’re dealing with an urgent expense or simply need a short-term financial boost, Capitec’s temporary loans are designed to provide the support you need. Remember to review all loan details carefully, consider the benefits of credit insurance, and ensure you meet all necessary requirements to increase your chances of approval.

For more personalized assistance, reach out directly to Capitec’s customer service or visit their official website to explore further options and get answers to any additional questions you might have.

References

- Capitec Bank Personal Loans

- Temporary Loan on Capitec App – TikTok

- Apply for a Temporary Loan at Capitec Bank

Author’s Note

As someone who has navigated the world of personal finance and loan applications, I understand how critical it is to have clear, reliable information when considering a temporary loan. My aim with this guide is to provide you with a comprehensive understanding of how to apply for a temporary loan at Capitec Bank, including all necessary steps, required documents, and key considerations.

If you have any questions or need further clarification, don’t hesitate to reach out or consult with a financial advisor. Loans can be a valuable tool for managing short-term financial needs, but it’s essential to fully understand the terms and implications before proceeding. Your financial well-being is important, and making informed decisions will help you navigate your options effectively.

Thank you for reading, and I hope this guide helps you in your journey to securing a temporary loan with Capitec Bank.

Source: Briefly

Oliver is a full-time writer with a passion for creating compelling content on diverse topics, including finance, business, product reviews, and more. With a keen eye for detail and a commitment to thorough research, she brings clarity and depth to complex subjects, making them accessible and engaging for readers. Oliver’s dedication to her craft ensures that every article is informative, well-researched, and thought-provoking. Outside of writing, she enjoys exploring new ideas, reading extensively, and continually expanding her knowledge.

Editorial Process

At Trusted Sources, our editorial process is crafted to ensure that every piece of content we produce—whether it’s an informational article or a review—meets the highest standards of accuracy, reliability, and engagement. Our commitment to delivering valuable, research-driven, and reader-centric content is reflected in our systematic and meticulous editorial approach.

Affiliate Disclosure

we are committed to transparency and honesty in all aspects of our operations, including our affiliate partnerships. We participate in various affiliate programs, which means we may earn commissions on qualifying purchases made through links on our Website.